Paige DeVriendt

On living A Value Savvy Life and transforming her relationship to spending and saving.

This is Paige, aka @avaluesavvylife. A champion of budgeting, financial transparency, and an Astor community member who’s bringing financial transparency to her TikTok audience. Her story really resonated with our team and hope it will for you too.

Hey Paige, please introduce yourself and tell us more about what motivated you to start talking about money!

I have been on a self-taught financial journey since I was 22, when I got my first job post-grad. I say “self-taught” because like many, I didn’t learn about budgeting, the stock market, or retirement accounts in school. I also didn’t grow up in a home where money was seen as neutral or a tool, just a stressor. While I didn’t know how exactly I was going to get there, I knew I wanted to “not have to worry about money” when I grew up.

Now, I’m 10 years into my journey and helping others start their financial journey with my TikTok, @avaluesavvylife. Finances are such a huge part of our life and society—and a lot of people put their head in the sand because it feels overwhelming—but knowing how much peace you can feel when you’re actually in control of your money is something I want as many women to experience as possible. I want to show women how they can use a budget and their money as a tool to build and live the life they dream of.

As a recovering perfectionist, I know how hard it can be to even get started when you feel like you don’t know everything or can’t do so “perfectly,” which I think a lot of women can relate to as well. I don’t think I am an expert by any means and want to be transparent about that. But beginning, even imperfectly, is the journey.

10 years in, I am still not fully confident in investing, but I do it anyway. Heck, I have been self-managing my brokerage account and realized 6 months in that I was only buying funds, not ETFs. Which isn’t bad, at least our money was still in the market, but I didn’t understand why I couldn’t find certain ticker symbols. I figured it out, though!

Thank you for sharing all of that. I totally empathize with being in the flow but not having it all dialed in yet. Will you share more of your financial upbringing?

I was raised in a middle class family in a small midwest town with my parents and 3 sisters. My parents always found a way to provide for us above and beyond (gymnastics, club volleyball, back to school shopping, and family vacations). But I remember knowing they had to sacrifice to give it to us. I don’t remember specifically when, but I started to associate money with stress and anxiety; that there was never enough.

I wanted to make my own money as soon as I could because I loved being able to provide for myself. And without having to feel guilty for asking. But I was never taught, or understood, the importance of saving any money. I spent pretty much everything, right when I made it. This was fine when I was in high school and didn’t have any bills of my own, but slowly I started seeing an issue with it.

In college I realized that some people weren’t struggling with money. I met people from all backgrounds, including many from big cities with parents with white collar jobs. I didn’t understand how much more money they had, or what they had done to reach that level of comfort, but I knew they definitely made more than I thought was possible. I remember one of my roommates asking me my senior year how much money I had saved and I said “‘nothing.” When I asked her how much she had saved, she said “$10,000.” I was shocked, to say the least.

After I graduated, I got a job across the country making $30,000 a year. I got a credit card with 0% interest intro rate and off I went. About 6 months in, I had racked up that card to $5K. I don’t even know on what. Luckily, it was 6 months before the 0% intro rate ended, and I decided to make a plan. So I created a spending tracker and picked up a second job coaching club volleyball to help pay off my card. I didn’t spend any of my volleyball money and put it all to the card. I was amazed at how much more in control of my money and at peace spending I felt now that I knew I was spending within my means.

Having a budget helped me realize I needed to make a lot more in order to live the life I wanted. So I left jobs for higher paying jobs and slowly made progress on other financial goals and at 25 I started working with a financial advisor to help me take the leap into investing outside of my 401K. I now self-manage everything at 32, but I know I wouldn’t have started on my own sooner because I lacked the confidence, and I am a perfectionist so it was hard for me to start.

A financial advisor at 25! That’s so impressive. What’s the most significant financial challenge you've faced, or are currently facing, and how are you tackling it?

The biggest financial challenge I face is student loan debt. My husband and I met in college which is fortunate, but we went to a private liberal arts college that cost an obscene amount of money. Plus my husband got a Masters degree. Combined, we have a little over $160K.

It is mentally exhausting and a burden that feels unbearable. It is very hard to forgive younger us for making the decision we didn’t know would affect us for decades to come. Like many, I struggle with the shame of it.

I’ve gone through phases where I think we need to Dave Ramsey the debt and pay it all off. But I have learned that it is mostly an emotional reaction and I am trying to work on making my feelings toward the debt be neutral. We have gotten to a place financially where, while it certainly isn’t fun watching $1,400+ a month go to the loans, but we can do it while covering necessities, saving, and still have money for some other things we love like travel. Which was a goal for me since young in my career; get to a point I can afford the payment while still enjoying life.

My husband and I have always been open about money, because we know it can be such a stressor for couples. We knew what we were getting into ahead of marriage, and now we work on it together. One of the first things we did when we got engaged was we started managing our money as “one” to ensure we were living within our means. I have pretty religiously used a budget tracker so just did everything there.

We refinanced my husband's largest private student loan which really lowered the interest rate. While we were saving for our home, we didn’t pay more than the minimums on any of our loans. Now that we are in a different financial spot and we have our house, we mapped out a couple different repayment plans that would help us pay off quicker by just paying a little more on some. We make sure to check in on our finances and money goals monthly so we are constantly confirming we are still aligned and make tweaks when we see fit. So this is working for now, but I could see us getting more aggressive in the future when we feel we are in a better place with our retirement savings.

Will you say more about those big goals and how they ladder up to your rich life?

To me, a rich life is living in a home somewhere I love, where I have room for friends and family to visit. I can afford to pick up dinner tabs for my friends and family, and can afford to help my nephews with college. I travel frequently, both international and in the states, for leisure and to see friends and family. I am not thinking about every penny because everything is automated and I know I am set up for my future.

I love how present tense that is! How do you approach setting these goals?

Every conversation with money starts with the budget. I am the one in the nitty gritty managing most of our finances, however, we discuss, make decisions, and allocate against them together.

I track every dime coming and going throughout the month and categorize it to ensure we are spending in line with our goals. We get together at the end of each month to reflect on the previous month's spend and any adjustments we want to make or anything coming up the following month. We also talk about if we want to make any shifts to our longer term goals like retirement. I think it’s incredibly important to have a budget. Start as soon as you can. It’s the easiest way to take control of your money and a necessary tool to achieve your financial goals.

What does financial freedom mean to you?

It’s peace of mind. Peace of mind that I know I can help others and still be comfortable myself. Peace of mind that I can leave a job or lose a job and be comfortable while I figure out whatever is next. Peace of mind that I will retire with good years left.

Yes, yes, yes! Will you share more about your investing strategy? As much as you feel comfortable, but so curious how you’re allocating assets.

I think it’s important to note I am married and while we have separate financial accounts, we do manage our finances as one. Take into consideration I am speaking in regards to a dual income household, both 32, no kids.

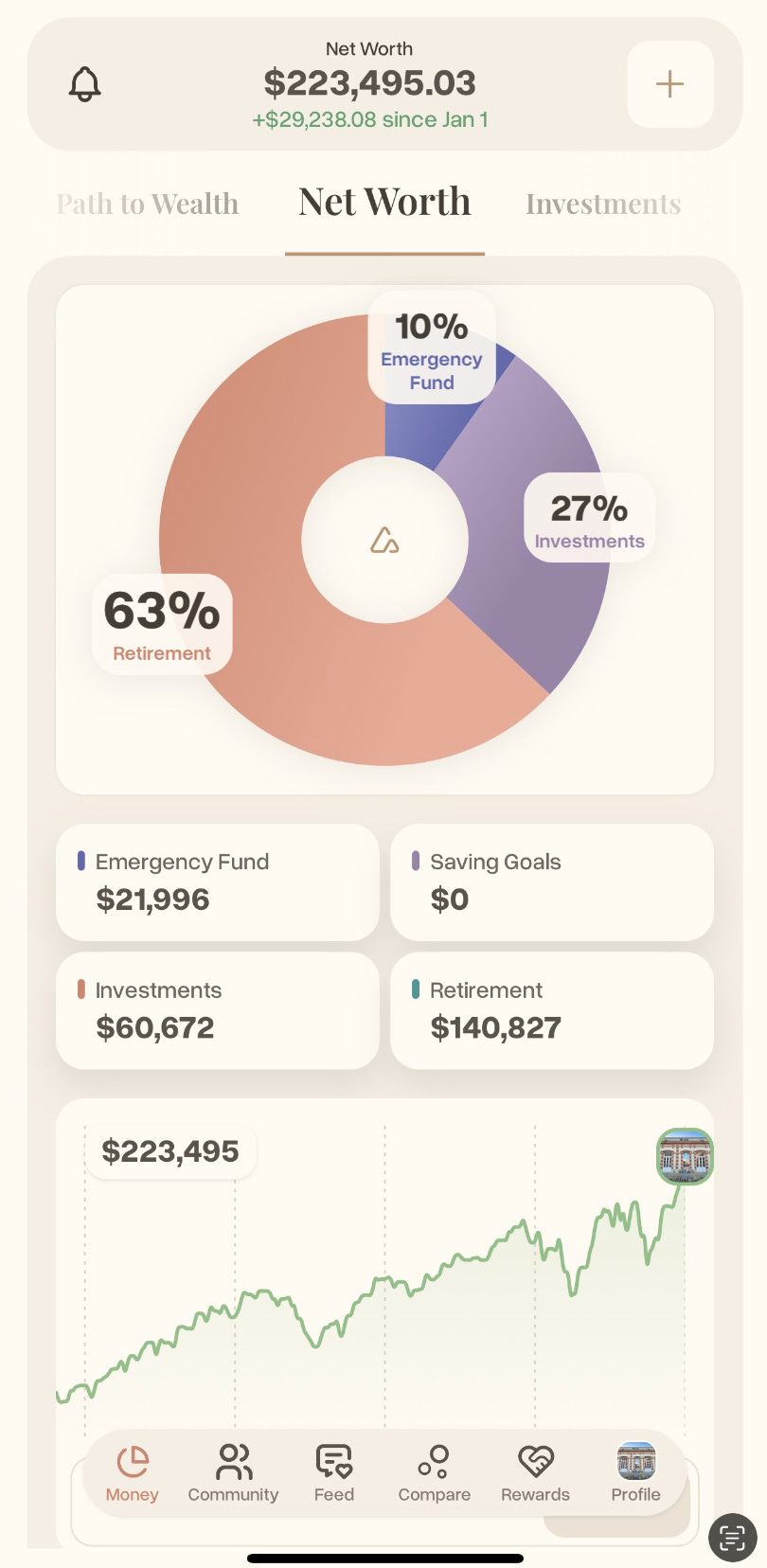

We are pretty heavily focused on retirement savings right now as we are trying to catch up. We want the tax advantages (of 401Ks) and we are trying to get it in there earlier so it grows larger for when we need it (due to time in the market).

I invest 17% of my income in my 401K to max out the annual amount you can contribute. I do this because my company matches 25 cents of every dollar up to the max contribution and I feel like I am behind from when I made much less in my 20s and was only contributing 5%.

Same with my Roth IRA. I started maxing it out 2.5 years ago when I started making over six figures. Again, trying to play catchup. This year I also started maxing out my HSA contribution so I can start investing through that.

And lastly I invest in a brokerage account which sort of varies but right now it’s about $600/month because we just increased my husband's 401K contributions from 6% of his income to 11%. We also max out his Roth IRA and HSA.

Incredible! I know you shared that you’re not perfect, which I appreciate, but I can absolutely see why you started making financial content. You speak with such ease!

Ah, thanks. I want to help encourage people to just get started. We need money to survive and money is a tool to live the life you want, but you have to work with it to make it work for you. You can’t just ignore it and hope for the best. Talking to my friends who are in the same career field as me has helped me grow my income because I knew what salaries were possible. Following people who talk openly about finances or provide financial education has helped me invest more than I would have otherwise.

If you don’t know what’s possible or hear about or see what’s possible, you just sort of think you’re stuck. I wanted people to know they’re not stuck and no matter where they are starting, they can take steps to better themselves financially and better their life overall.

Completely agree. That’s what we’re about at Astor.

Yes! I am excited to have community of like minded women to go to with any questions I have. Investing is part of my wealth building plan, but I’m not overly confident in it. I really get imposter syndrome talking about money because I know I am still learning—my strength really lies in budgeting and discipline. But I know investing is something I should spend more time with and have a stronger strategy I am more confident in. So I am excited to learn from other users in Astor to get there.

Paige, this has been so great. Thank you for sharing and I’m going to look at my spending tracker right now. Before we go, will you let us know where we can follow you?

I am currently on Tiktok as @avaluesavvylife!